In this post of “What is the history of cryptocurrency” cover the topic are Elevation of money, Early Days of Crypto currency, The Satoshi Nakamoto mystery, growth and volatility, Technological Advancements and Integration, Challenges and Future Outlook.

Imagine a world where money travels through a digital web, from the confines of banks and borders. Welcome to the fascinating journey of cryptocurrencies, a story that unfolds like a techno-thriller across the internet’s vast terrain.

What is the History of Bitcoin & Cryptocurrency? Before know about What is the history of cryptocurrency? First you understand the elevation of money

The elevation of money, What is the history of Bitcoin & cryptocurrency?

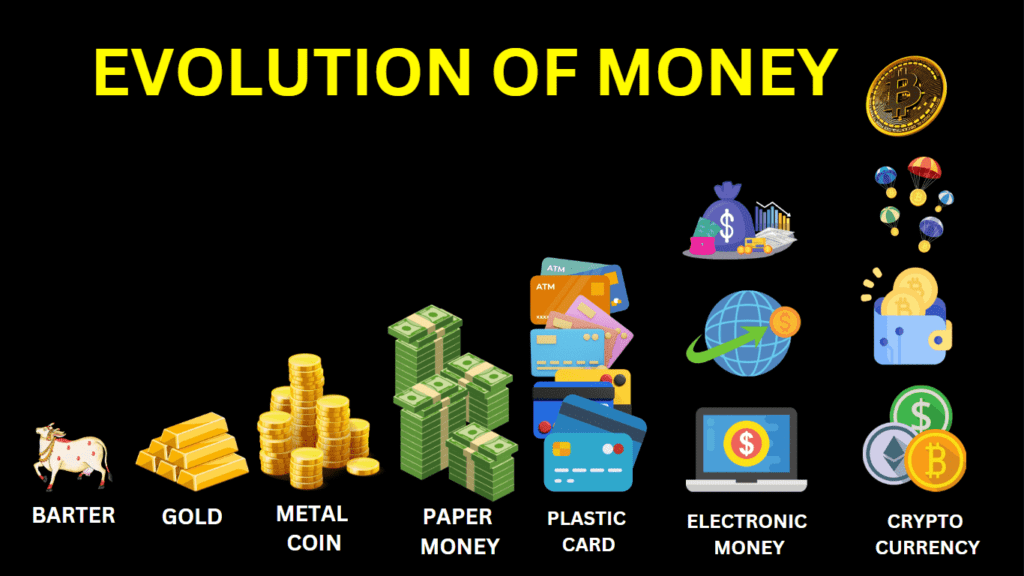

The elevation of money over the course of human history has been a fascinating journey, evolving from simple barter systems to complex financial instruments and digital currencies. Early societies engaged in direct exchange, trading goods and services without a standardized medium of exchange. The introduction of commodity money, such as gold and silver, marked a significant leap, providing a more universally accepted unit for transactions. As civilizations progressed, the concept of representative money emerged, where tokens or paper notes represented a claim on a commodity like gold held in reserve. In the modern era, fiat currencies, backed by the trust of the issuing government, became the norm. The digital revolution further elevated money, ushering in the era of cryptocurrencies, decentralized ledgers, and innovative financial technologies. This dynamic evolution reflects humanity’s continuous quest for efficient, secure, and adaptable means of facilitating economic transactions.

Our adventure begins in the shadows of 2008, a time of financial turmoil. A mysterious figure under the pseudonym Satoshi Nakamoto publishes a groundbreaking white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” This document lays the foundation for a radical new concept: a digital currency decentralized, secure, and controlled by its users.

Bitcoin swiftly takes root, its code spreading like wildfire through online communities. Early miners, pioneers armed with powerful computers, compete to unlock new coins, fueling the network’s growth. Transactions, transparent and unalterable, occur directly between individuals, bypassing the traditional financial system.

As Bitcoin gains traction, so does the broader concept of cryptocurrency. Other digital assets emerge, each offering unique features and functionalities. Ethereum, with its programmable smart contracts, opens doors for decentralized applications (DApps) and Web3 innovation. Litecoin focuses on faster transaction speeds, while privacy-centric coins like Monaro prioritize anonymity.

The crypto-verse explodes with exuberance, attracting investors, entrepreneurs, and curious minds alike. Prices soar, fueled by optimism and a dash of FOMO (fear of missing out). But the journey is not without its bumps. Security breaches, market crashes, and regulatory uncertainties test the young ecosystem’s resilience.

Through it all, the core principles of cryptocurrency remain steadfast: decentralization, transparency, and user empowerment. Communities rally around projects they believe in, fostering a spirit of collaboration and innovation. Developers tirelessly hone the technology, building a more robust and inclusive financial future.

Today, cryptocurrencies stand at a crossroads. While mainstream adoption is still evolving, their impact on the financial landscape is undeniable. Governments grapple with regulatory frameworks, central banks explore digital currencies of their own, and established financial institutions cautiously dip their toes into the digital pool.

One thing is for certain: the story of cryptocurrencies is far from over. As technology advances and communities thrive, this digital odyssey promises to take us on even more exciting adventures, redefining the way we think about money, ownership, and the very fabric of the financial world.

Early Days of Crypto currency:

The Satoshi Nakamoto mystery

In the annals of tech history, few figures capture the imagination like Satoshi Nakamoto. This elusive pseudonym shrouds the creator of Bitcoin, the revolutionary digital currency that sent shockwaves through the financial world. For over a decade, Satoshi’s true identity has remained a tantalizing mystery, fueling endless speculation and intrigue.

From Cypher punk Visionary to Bitcoin’s Birth:

In 2008, a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” landed in the digital world, igniting a technological revolution. The author, Satoshi Nakamoto, laid out a groundbreaking vision for a decentralized, digital currency from the shackles of traditional financial institutions. This audacious proposal, driven by the ideals of the cypher punk movement, sought to empower individuals and reclaim control over their money.

The Puzzle Begins:

Satoshi’s communication with the early Bitcoin community was primarily restricted to online forums and email exchanges. They meticulously avoided revealing personal details, maintaining a strict cloak of anonymity. This intentional shroud of mystery led to a whirlwind of speculation. Was Satoshi a lone genius, a collaborative team, or even a fictional persona?

Theories Abound:

Over the years, countless investigations and theories have emerged to unmask Satoshi. Some point to prominent figures in cryptography and computer science, while others delve into the murky world of cypherpunk enthusiasts. However, with each passing year, the concrete evidence remains elusive, adding to the allure of the enigma.

Beyond the Name:

While Satoshi’s identity remains a puzzle, the impact of their creation is undeniable. Bitcoin has redefined financial landscapes, spawned a burgeoning crypto ecosystem, and challenged the very notion of money. The questions surrounding Satoshi are less about a single individual and more about the power of decentralized ideas and the potential for technological disruption.

The Legacy Endures:

Satoshi Nakamoto may be shrouded in mystery, but their legacy burns bright. They ignited a digital revolution that continues to evolve and redefine our understanding of finance and technology. Whether their identity is ever revealed, the enigmatic architect of Bitcoin has left an indelible mark on the world, reminding us that even the most powerful revolutions can begin with a single, anonymous voice.

Go to Home Page

Growth and Volatility

Across the vast landscapes of markets, a curious partnership emerges: growth and volatility. Hand in hand, they waltz through industries, economies, and even individual portfolios, leaving a trail of both exhilarating gains and bone-chilling losses. Understanding this intricate dance is crucial for navigating the uncertainties of any investment journey.

Growth, the ever-optimistic leader, pushes for expansion. Like a budding seed reaching for the sunlight, companies, economies, and assets strive to increase their value, generating excitement and attracting investors. This upward climb, fueled by innovation, demand, and favorable conditions, promises prosperity and a chance to outpace the competition.

But volatility, the unpredictable jester, adds a touch of chaos to the mix. Imagine a gusty wind that can propel the growth forward to new heights or send it tumbling sideways. Economic shocks, unexpected events, and shifts in sentiment can cause rapid fluctuations, testing the nerves of even the most seasoned investors.

This dynamic duet shapes our investment landscape in fascinating ways:

- High-growth, high-volatility: Emerging markets, tech startups, and innovative ventures offer the potential for explosive returns, but the risk of equally dramatic crashes can’t be ignored. Remember, a rollercoaster ride can be thrilling, but not for the faint of heart.

- Low-growth, low-volatility: Mature companies, established economies, and defensive assets provide relative stability and predictable returns. While the excitement might be missing, the smooth sailing can offer peace of mind for risk-averse investors.

- The sweet spot: Finding the middle ground, where moderate growth coexists with manageable volatility, can be the key to building a balanced portfolio. Think of it as the comfortable cruise ship option, offering progress without the stomach-churning dips.

Understanding this delicate interplay is crucial for making informed investment decisions:

- Know your risk tolerance: Can you handle the thrill of a volatile market, or do you prefer calmer waters? Honoring your risk profile is key to staying on board the investment ship.

- Diversify your portfolio: Don’t put all your eggs in one basket. Spreading your investments across different asset classes and sectors can help mitigate the impact of volatility.

- Focus on the long term: While volatility may cause short-term jitters, remember that growth often plays out over a longer period. Stay focused on the bigger picture and avoid impulsive decisions based on temporary dips.

Technological Advancements and Integration

The crypto world isn’t just about digital coins and cryptic code. It’s a sprawling landscape constantly evolving, where cutting-edge tech weaves its magic, transforming how we interact with, manage, and utilize cryptocurrencies. Let’s dive into some thrilling technological advancements shaping the future of this digital frontier.

Scaling Up the Climb: Imagine millions of people transacting on a single blockchain, like trying to squeeze through a narrow doorway. Scaling solutions like Layer 2 networks come to the rescue, building express lanes alongside the main highway, speeding up transactions while keeping costs down. Think of it as adding more lanes to your favorite crypto highway, making transactions smoother and faster than ever before.

Smart Contracts: Where Code Meets Cash: No lawyers or paperwork needed! Smart contracts, self-executing agreements written in code, automate processes and ensure trustless, transparent transactions. Imagine buying a concert ticket or renting an apartment, all seamlessly handled by code, eliminating the need for intermediaries and their fees. These digital contracts pave the way for decentralized applications (dApps) building a whole new ecosystem on top of blockchains.

Interoperability: Breaking Down the Walls: Picture walled-off gardens within the crypto world, each blockchain an island unto itself. Interoperability bridges connect these islands, allowing data and assets to flow between different blockchains. Imagine sending your bitcoin to buy an NFT on the Ethereum network, seamlessly and securely, thanks to these technological bridges. This interconnected future opens up a world of possibilities for collaboration and innovation.

Privacy Preserved: Shrouding Your Crypto Footprint: Not everyone wants their every transaction on display. Privacy-focused technologies like zk-SNARKs and homomorphic encryption offer a cloak of invisibility, allowing you to prove you have funds without revealing your balance or transaction details. Imagine buying groceries with cryptocurrency without the cashier knowing how much you have in your digital wallet. These advancements empower individuals to regain control over their financial data.

Decentralized Finance: Banking Reimagined: Forget brick-and-mortar banks; DeFi, or decentralized finance, is revolutionizing how we manage money. Through lending, borrowing, and earning interest on your crypto, DeFi platforms offer alternatives to traditional financial services, often without gatekeepers or intermediaries. Think of it as a self-service financial supermarket, where you control your assets and access a range of financial tools, all powered by smart contracts and blockchain technology.

The Road Ahead: Innovation Never Sleeps: These are just some of the technological advancements propelling crypto forward. From quantum-resistant cryptography to artificial intelligence for security and fraud prevention, the future holds even more thrilling possibilities. Remember, the crypto world is an ever-evolving landscape, and staying informed about these technological leaps is key to navigating its exciting future.

Challenges and Opportunities in the Crypto

The vibrant realm of cryptocurrencies, while full of exhilarating possibilities, isn’t without its share of hurdles. As we traverse this digital odyssey, understanding the potential bumps in the road can help us navigate with informed perspective and optimism for the future.

Environmental Footprint: The energy consumption of some blockchain networks raises concerns about sustainability. Finding eco-friendly solutions, like proof-of-stake consensus mechanisms and renewable energy integration, is crucial for aligning crypto with a greener future.

Regulations and Uncertainty: Navigating the evolving regulatory landscape can be complex. Collaborating with policymakers and establishing clear frameworks can foster responsible innovation and build trust within the digital asset ecosystem.

Security Vulnerabilities: Cryptocurrency exchanges and wallets can be targets for cyberattacks. Prioritizing robust security measures, employing practices, and educating users about cyber hygiene are essential steps towards building a safer crypto haven.

Accessibility and inclusivity: Not everyone has equal access to or knowledge of cryptocurrencies. Addressing the digital divide, promoting financial literacy, and building user-friendly tools can open the doors of this digital financial world to a broader audience.

Social and Economic Implications: The potential impact of widespread crypto adoption on wealth distribution, economic stability, and global financial systems needs careful consideration and responsible development.

Despite these challenges, the future of cryptocurrencies shines bright with possibilities:

Mass Adoption: As user-friendliness improves and infrastructure expands, mainstream adoption of cryptocurrencies could revolutionize global financial systems, offering faster, cheaper, and more inclusive financial services.

Financial Innovation: Decentralized finance (DeFi) and blockchain technology pave the way for innovative financial products and services, empowering individuals and fostering greater financial inclusion.

Empowerment and Transparency: By putting control back in the hands of individuals and promoting transparency through blockchain technology, cryptocurrencies have the potential to reshape societal relationships with money and power.

Sustainable Solutions: Research and development are actively pursuing greener alternatives to energy-intensive blockchain protocols, promising a cleaner future for the digital asset revolution.